Ethereum

“Bitcoin’s Retail Comeback: Crucial Elements Fueling Resurgent Interest and Adoption”

Bitcoin’s changing position: From medium of exchange to asset of value The influence of these new participants on the realized cap—the average accumulation price of all BTC—is substantial. More than 40% of the recent impact on the realized cap originates from users who have held Bitcoin for three months or less.

“Improving Cryptographic Security through Distributed Key Generation in FROST”

grasping multisig and threshold signatures in bitcoin To tackle these challenges, the introduction of ChillDKG presents an encouraging solution. ChillDKG is an independent DKG protocol tailored for FROST, offering a ready-to-use framework that streamlines the implementation process. It encompasses secure communications and consensus mechanisms within the protocol, providing a user-friendly API that hides the underlying complexity.

Morgan Stanley Introduces Bitcoin ETFs for Wealth Management Clients

Morgan Stanley’s prudent stance on bitcoin ETFs Source: bitcoinmagazine.com Institutional embrace and sector influence Furthermore, Morgan Stanley’s action could have wider ramifications for the global financial sector. Being one of the top investment banks, their support for Bitcoin ETFs adds legitimacy to the asset class and may help alleviate some of the doubts surrounding cryptocurrencies.

“Congressman Wiley Nickel Promotes a Forward-Thinking Strategy for Bitcoin in the Democratic Agenda”

Shifting Perspectives of Democrats on Cryptocurrency Looking forward, Nickel imagines a future where the Democratic Party takes on a more crypto-friendly attitude, aligning with the increasing number of Americans with digital asset ownership. He believes that by engaging with industry experts and adopting pro-innovation strategies, the party can establish itself as a frontrunner in the digital economy.

“Thunder Funder: Enabling Retail Investors to Support Bitcoin Startups”

The mission and influence of Thunder Funder Thanks to Thunder Funder, everyday investors now have the chance to finance groundbreaking Bitcoin initiatives that were once reserved for accredited and institutional stakeholders. This innovation may expedite advancements and development within the Bitcoin and open-source landscape.

“Global Liquidity Hits All-Time High: Is Bitcoin Set to Gain?”

Bitcoin’s Relationship with Global Liquidity This amount recently approached trillion, nearing the remarkable 0 trillion mark. The previous high was around trillion, coinciding with Bitcoin reaching a record ATH of ,000 in March this year and trillion when it hit its maximum of ,000 in November 2021.

MicroStrategy Increases Bitcoin Holdings with $4.4M Acquisition of 169 BTC in July

MicroStrategy’s Bitcoin Purchase and Financial Results Looking forward, MicroStrategy is actively seeking fresh initiatives to strengthen its Bitcoin-focused strategy instead of resting on its achievements. A key new initiative is the introduction of “BTC Yield” as a significant performance indicator.

“Bitcoin’s Varied Dynamics: Coming Together Beyond Libertarian Principles”

Recognizing Constraints To address scalability issues, the adoption of layer-2 solutions and other technological innovations can be beneficial. For example, the Lightning Network represents a promising advancement aimed at increasing transaction speeds and reducing costs on the Bitcoin network. By embracing such solutions, Australians can experience quicker and more economical transactions, enhancing the practicality of cryptocurrencies for daily usage.

“Hong Kong’s Biggest Online Brokerage Launches Bitcoin Trading, Increasing Accessibility to Digital Assets”

Futu’s venture into consumer Bitcoin trading Source: bitcoinmagazine.com Futu is temporarily eliminating Bitcoin trading fees to capture more market share. It is collaborating with the licensed exchange HashKey to facilitate trading under SFC regulations. This development follows Hong Kong’s earlier approval of an exchange-traded fund for Bitcoin and Ethereum this year.

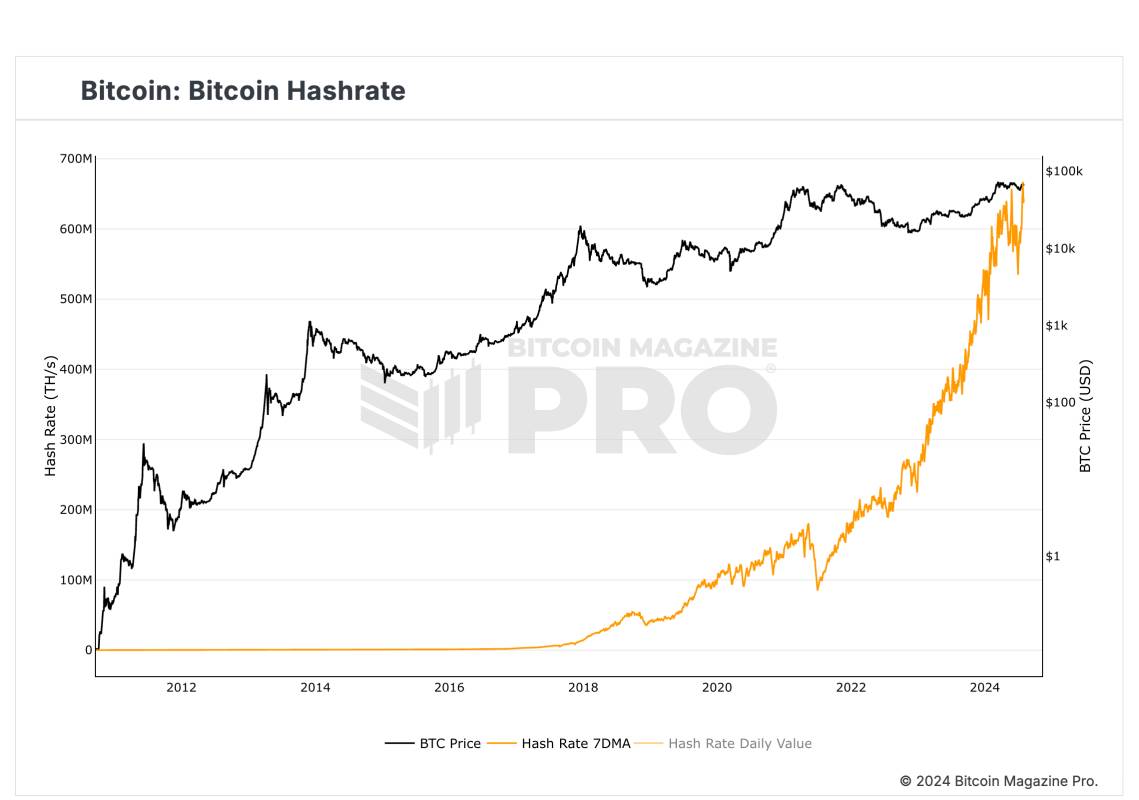

“Bitcoin Hashrate Hits All-Time High Following Trump’s Endorsement of the Industry”

Innovations in Bitcoin mining and industry backing Beyond hardware advancements, miners are also looking into artificial intelligence (AI) integration to boost operational efficiency and tackle identity challenges. This technological adaptation is anticipated to optimize mining operations, cut costs, and enhance overall security.