Ethereum

“Channeling Frustration: Grasping the Intricacies of Bitcoin Core and Fostering Positive Discussion”

Your Node, Your Responsibility In the Australian crypto landscape, we take pride in our independent thinking. This involves taking control of our technology stack. If you’re managing a node, it’s crucial to understand its function and rationale. If a change doesn’t suit you, simply don’t accept it.

“Report from CoinCorner Shows Most Bitcoin Holders in the UK Adopt ‘HODL’ Strategy”

Trends in Bitcoin Accumulation Among UK Investors The 2024 UK Customer Report by CoinCorner provides a clear insight into how everyday investors are engaging with Bitcoin — debunking the typical high-stakes trading image that many Australians might anticipate. The data indicates a significant preference for long-term accumulation, as evidenced by 51% of users never having sold their Bitcoin.

“Bitcoin Magazine Unveils Exclusive V3 Bitcoin-Inspired Crocs”

Collaboration on Bitcoin-inspired footwear With only 2,100 pairs produced worldwide, the V3 Bitcoin Crocs release exemplifies how scarcity aligns with style—an idea that resonates strongly with Bitcoin values. For Australian Bitcoiners, this exclusive release is not solely about shoes; it signifies owning a fragment of crypto culture that reflects the ideals of sound money and limited supply.

“Dubai Leads the Way in Digital Economy by Allowing Bitcoin and Crypto for Government Services”

Dubai adopts Bitcoin for government transactions Source: bitcoinmagazine.com For Australians, particularly those in the blockchain and fintech domains, this is a pivotal moment for learning. The Dubai-Crypto.com partnership exemplifies how to embed cryptocurrency into public services without sacrificing security, efficiency, or compliance.

“Coinbase Becomes the Initial Cryptocurrency Firm to Enter S&P 500, Indicating Mainstream Embrace”

Coinbase enters the S&P 500 For Australian investors keeping an eye on the global cryptocurrency landscape, this is a significant confirmation moment. Coinbase’s addition implies that every fund tracking the S&P 500 will now have to include COIN stock. That’s significant—it generates immediate demand for the stock and potentially influences short-term price movements.

The Blockchain Group Secures €22M to Improve Bitcoin Treasury Approach

Equity raise fueled by Bitcoin indicates institutional trust Major institutional players joined the effort significantly: This convertible note is far from ordinary. It’s Tranche 2 of ALTBG’s OCA convertible series, issued at a 30% premium over the conversion price of Tranche 1.

“Gryphon Joins Forces with Eric Trump’s American Bitcoin: An Evolutionary Shift in Crypto Mining”

Merger between Gryphon and American Bitcoin The newly established entity, operating under the American Bitcoin name, aims to become the most efficient Bitcoin mining firm in the world—a bold target that underscores the merger’s significance. Central to this initiative is a dual emphasis on low-cost energy infrastructure and a solid Bitcoin reserve model, both expected to provide a competitive advantage in a sector where profit margins are increasingly pressured by higher hash rates and regulatory oversight.

“Hut 8 Declares $134M Loss in Q1 While Shifting to Energy Infrastructure and Bitcoin Mining”

Financial results and strategic ventures Hut 8’s expansion blueprint is progressing well, with several vital infrastructure projects moving forward across North America—developments that Australian crypto fans will want to monitor closely as they indicate where the next surge of hashpower and energy innovations may arise.

Coinbase Introduces Round-the-Clock Bitcoin Futures Trading, Revolutionizing U.S. Crypto Market

Coinbase introduces round-the-clock bitcoin futures trading Coinbase has formally announced the launch of 24/7 trading for Bitcoin futures, representing a significant advancement in the development of crypto markets in the United States. For the first time, leveraged Bitcoin futures contracts will be accessible continuously on a CFTC-regulated exchange, eliminating the conventional constraints of trading hours.

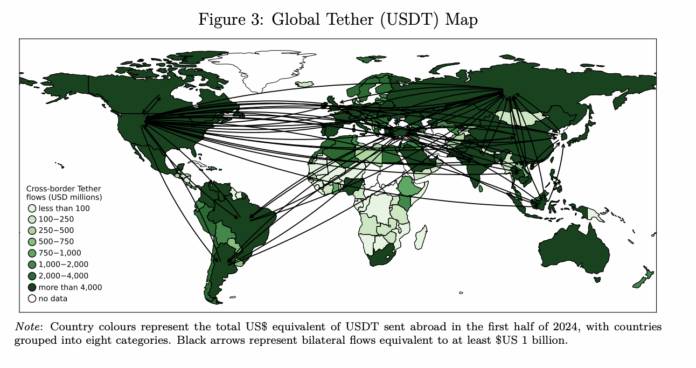

“According to a BIS report, Bitcoin’s Surge as a Financial Safeguard in Times of Economic Distress”

Bitcoin utilization increases amid economic turmoil A recent BIS document on Bitcoin found that utilization increases when inflation rises, remittance costs climb, and capital controls become more restrictive. In simpler terms, it’s when people need it the most. As economic conditions worsen, the adoption of Bitcoin often experiences a significant uptick—particularly in nations facing severe inflation, costly remittance options, or stringent capital regulations.